library(tidymodels)

library(xgboost)

library(vip) # For variable importance

library(stringr) # For string manipulation functions

library(probably) # For calibration plots

library(ROSE) # For imbalanced data visualization

library(corrplot) # For correlation visualizationBuilding Models in R with tidymodels

The tidymodels framework provides a cohesive set of packages for modeling and machine learning in R, following tidyverse principles. In this post, we’ll build a realistic credit scoring model using tidymodels.

Credit scoring models are used by financial institutions to assess the creditworthiness of borrowers. These models predict the probability of default (failure to repay a loan) based on borrower characteristics and loan attributes. A good credit scoring model should effectively discriminate between high-risk and low-risk borrowers, be well-calibrated, and provide interpretable insights.

Required Packages

First, let’s load all the required packages for our analysis:

Synthetic Data Generation

This tutorial uses a simulated credit dataset incorporating realistic variable distributions commonly encountered in credit scoring applications. The synthetic data includes demographic information, loan characteristics, and credit history variables with appropriate statistical relationships.

set.seed(123)

n <- 10000 # Larger sample size for more realistic modeling

# Create base features with realistic distributions

data <- tibble(

customer_id = paste0("CUS", formatC(1:n, width = 6, format = "d", flag = "0")),

# Demographics - with realistic age distribution for credit applicants

age = pmax(18, pmin(80, round(rnorm(n, 38, 13)))),

income = pmax(12000, round(rlnorm(n, log(52000), 0.8))),

employment_length = pmax(0, round(rexp(n, 1/6))), # Exponential distribution for job tenure

home_ownership = sample(c("RENT", "MORTGAGE", "OWN"), n, replace = TRUE, prob = c(0.45, 0.40, 0.15)),

# Loan characteristics - with more realistic correlations

loan_amount = round(rlnorm(n, log(15000), 0.7) / 100) * 100, # Log-normal for loan amounts

loan_term = sample(c(36, 60, 120), n, replace = TRUE, prob = c(0.6, 0.3, 0.1)),

# Credit history - with more realistic distributions

credit_score = round(pmin(850, pmax(300, rnorm(n, 700, 90)))),

dti_ratio = pmax(0, pmin(65, rlnorm(n, log(20), 0.4))), # Debt-to-income ratio

delinq_2yrs = rpois(n, 0.4), # Number of delinquencies in past 2 years

inq_last_6mths = rpois(n, 0.7), # Number of inquiries in last 6 months

open_acc = pmax(1, round(rnorm(n, 10, 4))), # Number of open accounts

pub_rec = rbinom(n, 2, 0.06), # Number of public records

revol_util = pmin(100, pmax(0, rnorm(n, 40, 20))), # Revolving utilization

total_acc = pmax(open_acc, open_acc + round(rnorm(n, 8, 6))) # Total accounts

)

# Add realistic correlations between variables

data <- data %>%

mutate(

# Interest rate depends on credit score and loan term

interest_rate = 25 - (credit_score - 300) * (15/550) +

ifelse(loan_term == 36, -1, ifelse(loan_term == 60, 0, 1.5)) +

rnorm(n, 0, 1.5),

# Loan purpose with realistic probabilities

loan_purpose = sample(

c("debt_consolidation", "credit_card", "home_improvement", "major_purchase", "medical", "other"),

n, replace = TRUE,

prob = c(0.45, 0.25, 0.10, 0.08, 0.07, 0.05)

),

# Add some derived features that have predictive power

payment_amount = (loan_amount * (interest_rate/100/12) * (1 + interest_rate/100/12)^loan_term) /

((1 + interest_rate/100/12)^loan_term - 1),

payment_to_income_ratio = (payment_amount * 12) / income

)

# Create a more realistic default probability model with non-linear effects

logit_default <- with(data, {

-4.5 + # Base intercept for ~10% default rate

-0.03 * (age - 18) + # Age effect (stronger for younger borrowers)

-0.2 * log(income/10000) + # Log-transformed income effect

-0.08 * employment_length + # Employment length effect

ifelse(home_ownership == "OWN", -0.7, ifelse(home_ownership == "MORTGAGE", -0.3, 0)) + # Home ownership

0.3 * log(loan_amount/1000) + # Log-transformed loan amount

ifelse(loan_term == 36, 0, ifelse(loan_term == 60, 0.4, 0.8)) + # Loan term

0.15 * interest_rate + # Interest rate effect

ifelse(loan_purpose == "debt_consolidation", 0.5,

ifelse(loan_purpose == "credit_card", 0.4,

ifelse(loan_purpose == "medical", 0.6, 0))) + # Loan purpose

-0.01 * (credit_score - 300) + # Credit score (stronger effect at lower scores)

0.06 * dti_ratio + # DTI ratio effect

0.4 * delinq_2yrs + # Delinquencies effect (stronger effect for first delinquency)

0.3 * inq_last_6mths + # Inquiries effect

-0.1 * log(open_acc + 1) + # Open accounts (log-transformed)

0.8 * pub_rec + # Public records (strong effect)

0.02 * revol_util + # Revolving utilization

1.2 * payment_to_income_ratio + # Payment to income ratio (strong effect)

rnorm(n, 0, 0.8) # Add some noise for realistic variation

})

# Generate default flag with realistic default rate

prob_default <- plogis(logit_default)

data$default <- factor(rbinom(n, 1, prob_default), levels = c(0, 1), labels = c("no", "yes"))

# Check class distribution

table(data$default)

no yes

9425 575 prop.table(table(data$default))

no yes

0.9425 0.0575 # Visualize the default rate

ggplot(data, aes(x = default, fill = default)) +

geom_bar(aes(y = ..prop.., group = 1)) +

scale_y_continuous(labels = scales::percent) +

labs(title = "Class Distribution in Credit Dataset",

y = "Percentage") +

theme_minimal()

# Visualize the relationship between key variables and default rate

ggplot(data, aes(x = credit_score, y = as.numeric(default) - 1)) +

geom_smooth(method = "loess") +

labs(title = "Default Rate by Credit Score",

x = "Credit Score", y = "Default Probability") +

theme_minimal()

# Examine correlation between numeric predictors

credit_cors <- data %>%

select(age, income, employment_length, loan_amount, interest_rate,

credit_score, dti_ratio, delinq_2yrs, revol_util, payment_to_income_ratio) %>%

cor()

corrplot(credit_cors, method = "circle", type = "upper",

tl.col = "black", tl.srt = 45, tl.cex = 0.7)

Stratified Partitioning

Credit default datasets typically exhibit class imbalance, with default events representing the minority class. We implement stratified sampling to preserve the class distribution across training, validation, and test partitions.

# Create initial train/test split (80/20)

set.seed(456)

initial_split <- initial_split(data, prop = 0.8, strata = default)

train_data <- training(initial_split)

test_data <- testing(initial_split)

# Create validation set from training data (75% train, 25% validation)

set.seed(789)

validation_split <- initial_split(train_data, prop = 0.75, strata = default)

# Check class imbalance in training data

train_class_counts <- table(training(validation_split)$default)

train_class_props <- prop.table(train_class_counts)

cat("Training data class distribution:\n")Training data class distribution:print(train_class_counts)

no yes

5661 339 cat("\nPercentage:\n")

Percentage:print(train_class_props * 100)

no yes

94.35 5.65 # Visualize class imbalance

ROSE::roc.curve(training(validation_split)$default == "yes",

training(validation_split)$credit_score,

plotit = TRUE, main = "ROC Curve for Credit Score Alone")

Area under the curve (AUC): 0.753Feature Engineering and Preprocessing

The following section develops a preprocessing recipe incorporating domain-specific feature engineering techniques relevant to credit risk modeling, including class imbalance handling strategies.

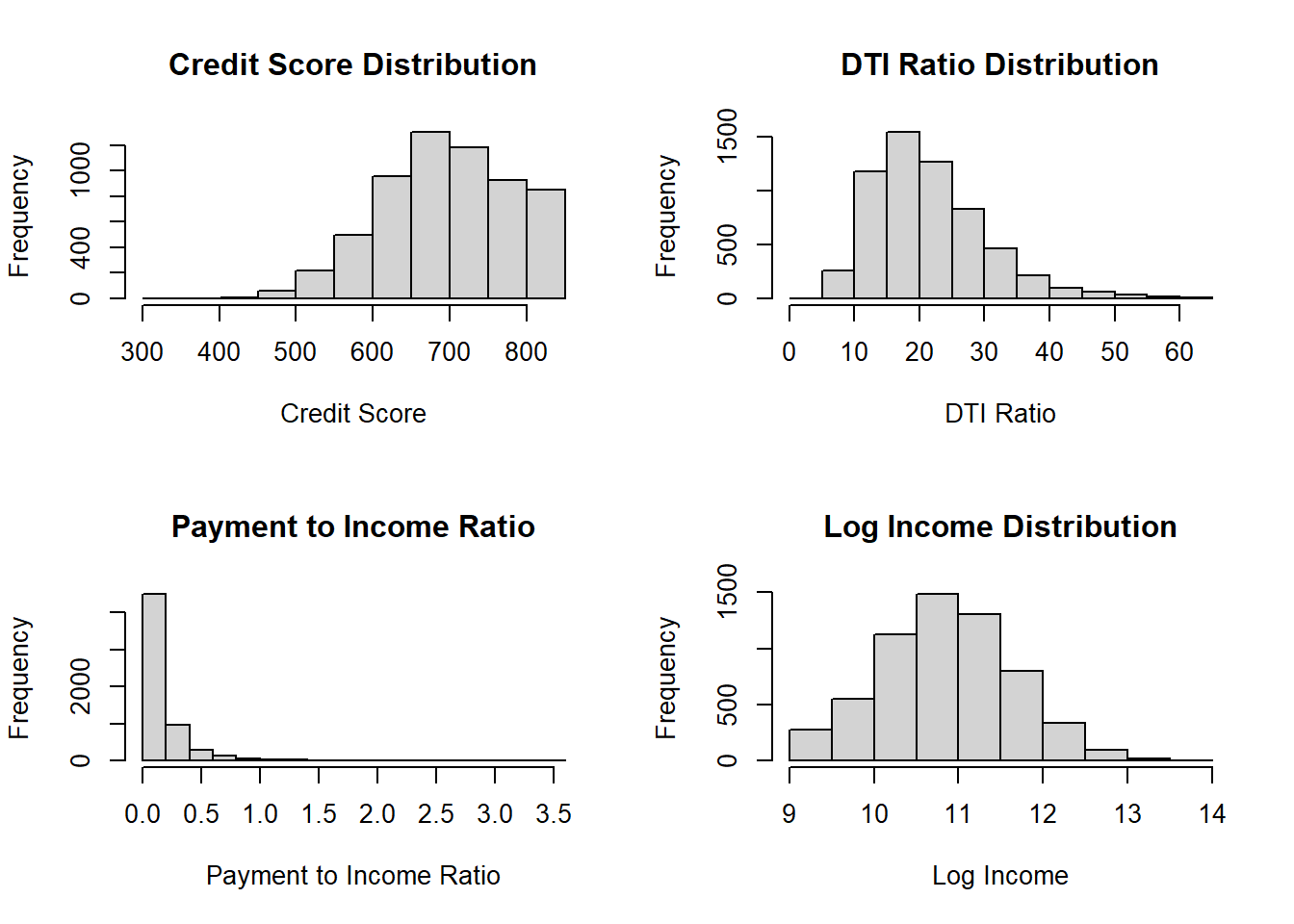

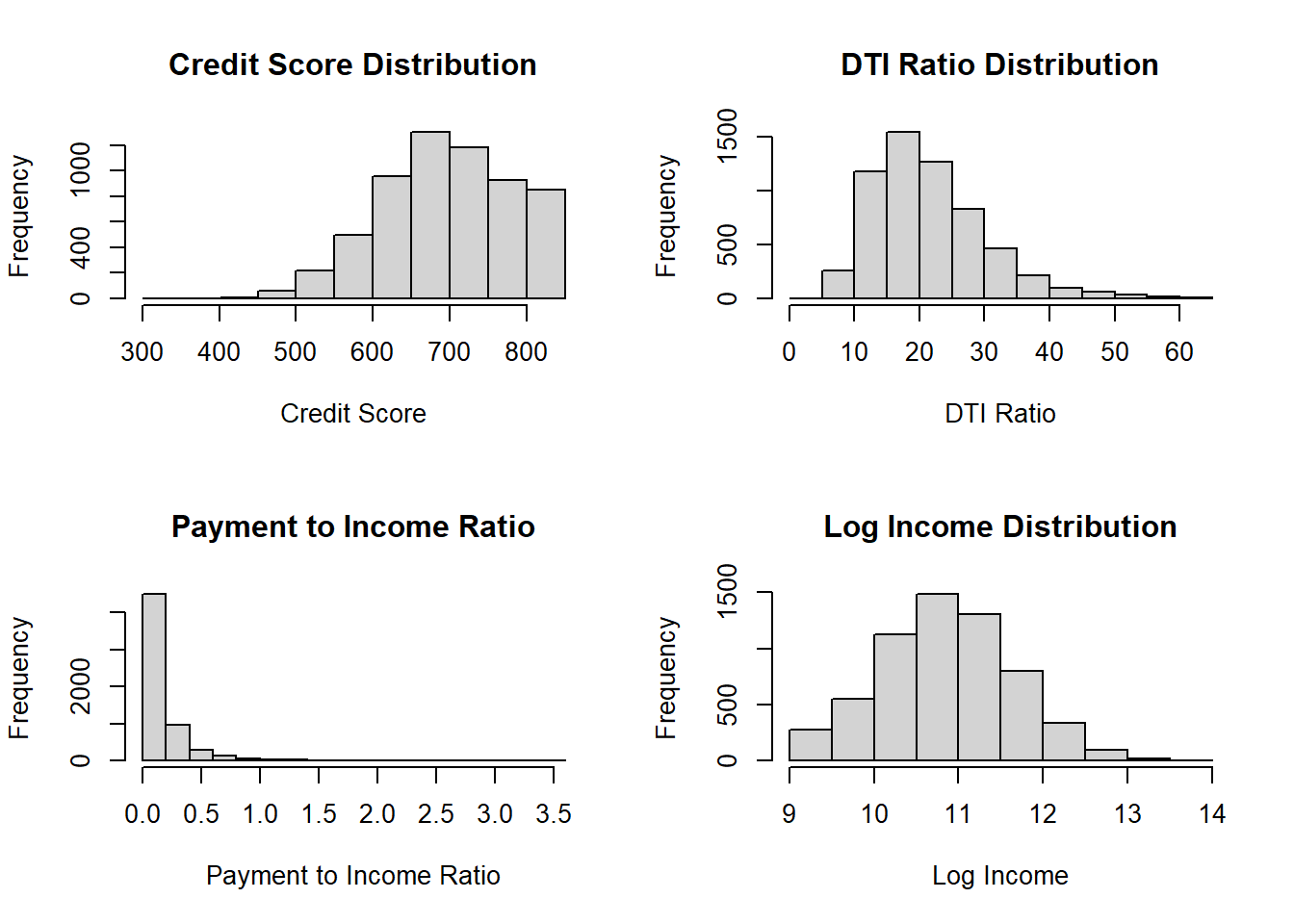

# Examine the distributions of key variables

par(mfrow = c(2, 2))

hist(training(validation_split)$credit_score,

main = "Credit Score Distribution", xlab = "Credit Score")

hist(training(validation_split)$dti_ratio,

main = "DTI Ratio Distribution", xlab = "DTI Ratio")

hist(training(validation_split)$payment_to_income_ratio,

main = "Payment to Income Ratio",

xlab = "Payment to Income Ratio")

hist(log(training(validation_split)$income),

main = "Log Income Distribution", xlab = "Log Income")

par(mfrow = c(1, 1))# Create a recipe

credit_recipe <- recipe(default ~ ., data = training(validation_split)) %>%

# Remove ID column

step_rm(customer_id) %>%

# Convert categorical variables to factors

step_string2factor(home_ownership, loan_purpose) %>%

# Create additional domain-specific features

step_mutate(

# We already have payment_to_income_ratio from data generation

# Add more credit risk indicators

credit_utilization = revol_util / 100,

acc_to_age_ratio = total_acc / age,

delinq_per_acc = ifelse(total_acc > 0, delinq_2yrs / total_acc, 0),

inq_rate = inq_last_6mths / (open_acc + 0.1), # Inquiry rate relative to open accounts

term_factor = loan_term / 12, # Term in years

log_income = log(income), # Log transform income

log_loan = log(loan_amount), # Log transform loan amount

payment_ratio = payment_amount / (income / 12), # Monthly payment to monthly income

util_to_income = (revol_util / 100) * (dti_ratio / 100) # Interaction term

) %>%

# Handle categorical variables

step_dummy(all_nominal_predictors()) %>%

# Impute missing values (if any)

step_impute_median(all_numeric_predictors()) %>%

# Transform highly skewed variables

step_YeoJohnson(income, loan_amount, payment_amount) %>%

# Remove highly correlated predictors

step_corr(all_numeric_predictors(), threshold = 0.85) %>%

# Normalize numeric predictors

step_normalize(all_numeric_predictors()) %>%

# Remove zero-variance predictors

step_zv(all_predictors())

# Prep the recipe to examine the steps

prepped_recipe <- prep(credit_recipe)

prepped_recipe

# Check the transformed data

recipe_data <- bake(prepped_recipe, new_data = NULL)

glimpse(recipe_data)Rows: 6,000

Columns: 27

$ age <dbl> -0.58938716, 1.60129128, 0.05970275, 0…

$ employment_length <dbl> 1.01545119, 0.17764322, 2.35594395, -0…

$ loan_amount <dbl> -0.30772032, -1.64018559, 0.01897785, …

$ credit_score <dbl> -1.66355858, -1.60583467, 0.02197934, …

$ dti_ratio <dbl> -1.10745919, -0.21368748, -1.26746777,…

$ delinq_2yrs <dbl> -0.6423758, -0.6423758, -0.6423758, -0…

$ inq_last_6mths <dbl> -0.8324634, 1.5511111, -0.8324634, -0.…

$ open_acc <dbl> -0.516984456, -1.282635289, -1.2826352…

$ pub_rec <dbl> -0.3429372, -0.3429372, 2.7652549, -0.…

$ total_acc <dbl> 0.39969129, 0.54625046, -0.47966374, 0…

$ interest_rate <dbl> 1.47394527, 1.51546694, -0.11980960, 0…

$ default <fct> no, no, no, no, no, no, no, no, yes, n…

$ credit_utilization <dbl> -1.841097091, 2.786415973, -1.09378697…

$ acc_to_age_ratio <dbl> 0.50174733, -0.54849606, -0.52980631, …

$ delinq_per_acc <dbl> -0.44991964, -0.44991964, -0.44991964,…

$ inq_rate <dbl> -0.520358012, 1.759991048, -0.52035801…

$ term_factor <dbl> 0.3219163, -0.6274559, 0.3219163, -0.6…

$ log_income <dbl> 2.44464243, 0.95097048, -0.59583257, 0…

$ payment_ratio <dbl> -0.70055763, -0.66316187, -0.18762635,…

$ util_to_income <dbl> -1.4271447, 1.7533431, -1.1717989, -1.…

$ home_ownership_OWN <dbl> -0.4238857, -0.4238857, -0.4238857, -0…

$ home_ownership_RENT <dbl> -0.8977787, -0.8977787, 1.1136746, 1.1…

$ loan_purpose_debt_consolidation <dbl> 1.1204596, -0.8923421, -0.8923421, -0.…

$ loan_purpose_home_improvement <dbl> -0.3277222, -0.3277222, 3.0508567, -0.…

$ loan_purpose_major_purchase <dbl> -0.2968579, -0.2968579, -0.2968579, -0…

$ loan_purpose_medical <dbl> -0.299178, -0.299178, -0.299178, -0.29…

$ loan_purpose_other <dbl> -0.2208157, -0.2208157, -0.2208157, -0…# Verify

table(recipe_data$default)

no yes

5661 339 Model Architecture and Hyperparameter Optimization

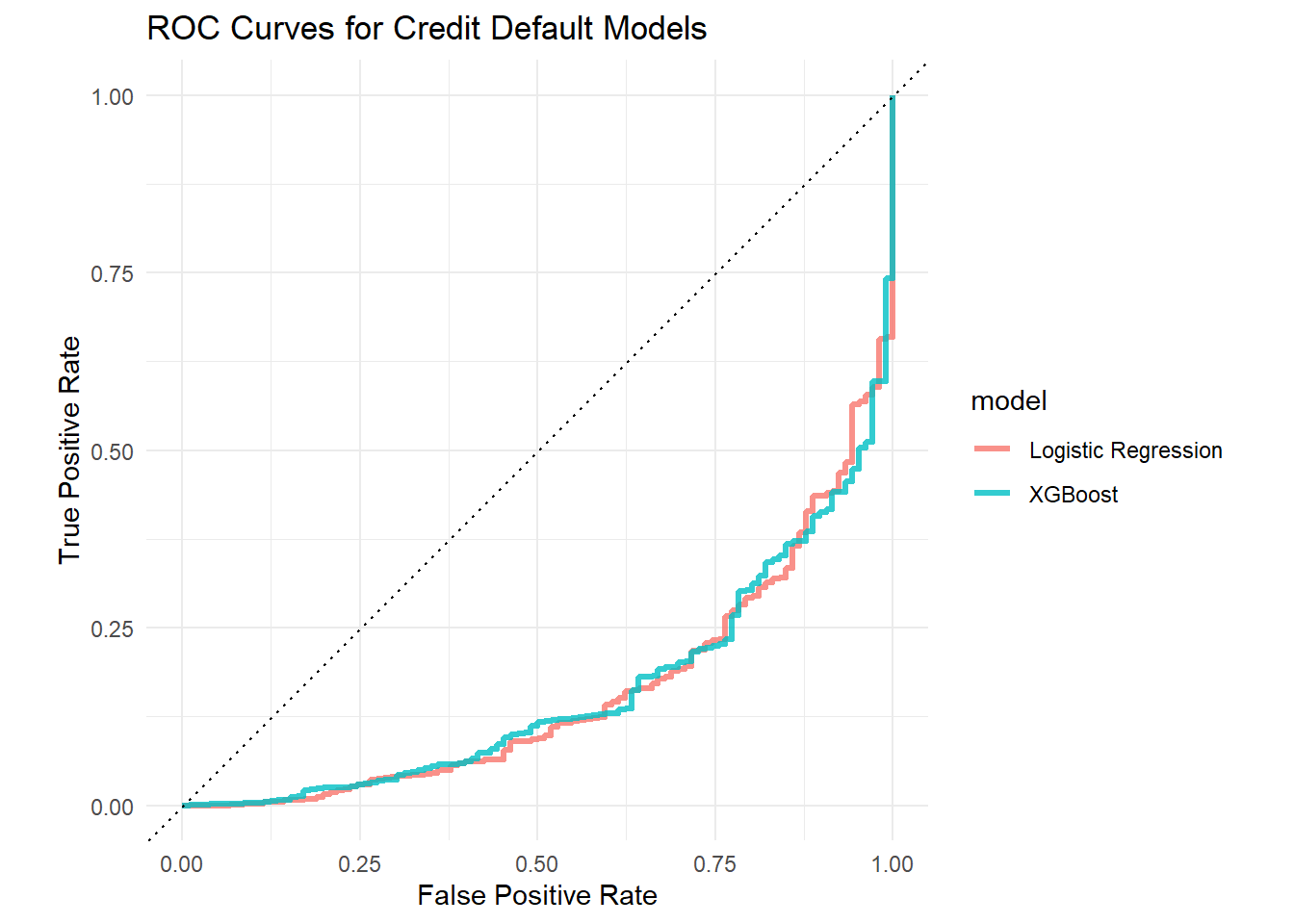

This section implements both traditional (logistic regression) and modern (XGBoost) algorithms. Logistic regression provides interpretability required for regulatory compliance, while XGBoost offers superior predictive performance. Both models undergo systematic hyperparameter tuning using cross-validation.

# Define the logistic regression model

log_reg_spec <- logistic_reg(penalty = tune(), mixture = tune()) %>%

set_engine("glmnet") %>%

set_mode("classification")

# Create a logistic regression workflow

log_reg_workflow <- workflow() %>%

add_recipe(credit_recipe) %>%

add_model(log_reg_spec)

# Define the tuning grid for logistic regression

log_reg_grid <- grid_regular(

penalty(range = c(-5, 0), trans = log10_trans()),

mixture(range = c(0, 1)),

levels = c(10, 5)

)

# Define the XGBoost model with tunable parameters

xgb_spec <- boost_tree(

trees = tune(),

tree_depth = tune(),

min_n = tune(),

loss_reduction = tune(),

mtry = tune(),

learn_rate = tune()

) %>%

set_engine("xgboost", objective = "binary:logistic") %>%

set_mode("classification")

# Create an XGBoost workflow

xgb_workflow <- workflow() %>%

add_recipe(credit_recipe) %>%

add_model(xgb_spec)

# Define the tuning grid for XGBoost

xgb_grid <- grid_latin_hypercube(

trees(range = c(50, 100)),

tree_depth(range = c(3, 6)),

min_n(range = c(2, 8)),

loss_reduction(range = c(0.001, 1.0)),

mtry(range = c(5, 20)),

learn_rate(range = c(-4, -1), trans = log10_trans()),

size = 10

)

# Create cross-validation folds with stratification

set.seed(234)

cv_folds <- vfold_cv(training(validation_split), v = 3, strata = default)

# Define the metrics to evaluate

classification_metrics <- metric_set(

roc_auc, # Area under the ROC curve

pr_auc, # Area under the precision-recall curve

)

# Tune the logistic regression model

set.seed(345)

log_reg_tuned <- tune_grid(

log_reg_workflow,

resamples = cv_folds,

grid = log_reg_grid,

metrics = classification_metrics,

control = control_grid(save_pred = TRUE, verbose = TRUE)

)

# Tune the XGBoost model

set.seed(456)

xgb_tuned <- tune_grid(

xgb_workflow,

resamples = cv_folds,

grid = xgb_grid,

metrics = classification_metrics,

control = control_grid(save_pred = TRUE, verbose = TRUE)

)

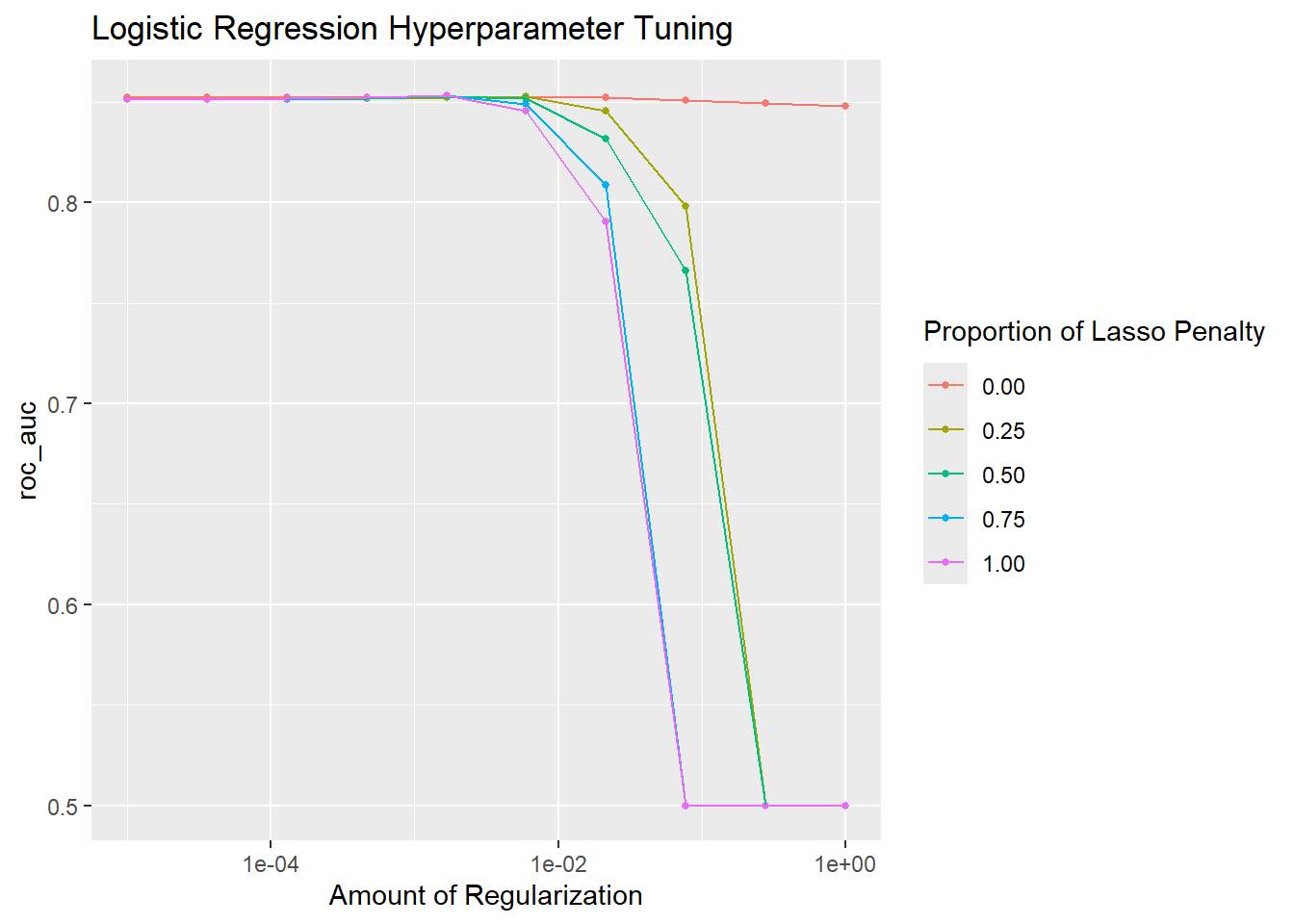

# Collect and visualize logistic regression tuning results

log_reg_results <- log_reg_tuned %>% collect_metrics()

log_reg_results %>% filter(.metric == "roc_auc") %>% arrange(desc(mean)) %>% head()# A tibble: 6 × 8

penalty mixture .metric .estimator mean n std_err .config

<dbl> <dbl> <chr> <chr> <dbl> <int> <dbl> <chr>

1 0.00167 1 roc_auc binary 0.853 3 0.00841 pre0_mod25_post0

2 0.00167 0.75 roc_auc binary 0.853 3 0.00841 pre0_mod24_post0

3 0.00599 0.25 roc_auc binary 0.853 3 0.00869 pre0_mod27_post0

4 0.00167 0.5 roc_auc binary 0.853 3 0.00836 pre0_mod23_post0

5 0.000464 1 roc_auc binary 0.852 3 0.00817 pre0_mod20_post0

6 0.00167 0.25 roc_auc binary 0.852 3 0.00837 pre0_mod22_post0Model Finalization and Performance Evaluation

This section focuses on finalizing both models using their optimal hyperparameters and evaluating model performance on the validation dataset.

# Select best hyperparameters based on ROC AUC

best_log_reg_params <- select_best(log_reg_tuned, metric = "roc_auc")

best_xgb_params <- select_best(xgb_tuned, metric = "roc_auc")

# Finalize workflows with best parameters

final_log_reg_workflow <- log_reg_workflow %>%

finalize_workflow(best_log_reg_params)

final_xgb_workflow <- xgb_workflow %>%

finalize_workflow(best_xgb_params)

# Fit the final models on the full training data

final_log_reg_model <- final_log_reg_workflow %>%

fit(data = training(validation_split))

final_xgb_model <- final_xgb_workflow %>%

fit(data = training(validation_split))

# Make predictions on the validation set with both models

log_reg_val_results <- final_log_reg_model %>%

predict(testing(validation_split)) %>%

bind_cols(predict(final_log_reg_model, testing(validation_split), type = "prob")) %>%

bind_cols(testing(validation_split) %>% select(default, customer_id))

xgb_val_results <- final_xgb_model %>%

predict(testing(validation_split)) %>%

bind_cols(predict(final_xgb_model, testing(validation_split), type = "prob")) %>%

bind_cols(testing(validation_split) %>% select(default, customer_id))

# Evaluate model performance on validation set

log_reg_val_metrics <- log_reg_val_results %>%

metrics(truth = default, estimate = .pred_class, .pred_yes)

xgb_val_metrics <- xgb_val_results %>%

metrics(truth = default, estimate = .pred_class, .pred_yes)

cat("Logistic Regression Validation Metrics:\n")Logistic Regression Validation Metrics:print(log_reg_val_metrics)# A tibble: 4 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 accuracy binary 0.950

2 kap binary 0.145

3 mn_log_loss binary 3.64

4 roc_auc binary 0.157cat("\nXGBoost Validation Metrics:\n")

XGBoost Validation Metrics:print(xgb_val_metrics)# A tibble: 4 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 accuracy binary 0.950

2 kap binary 0.158

3 mn_log_loss binary 3.25

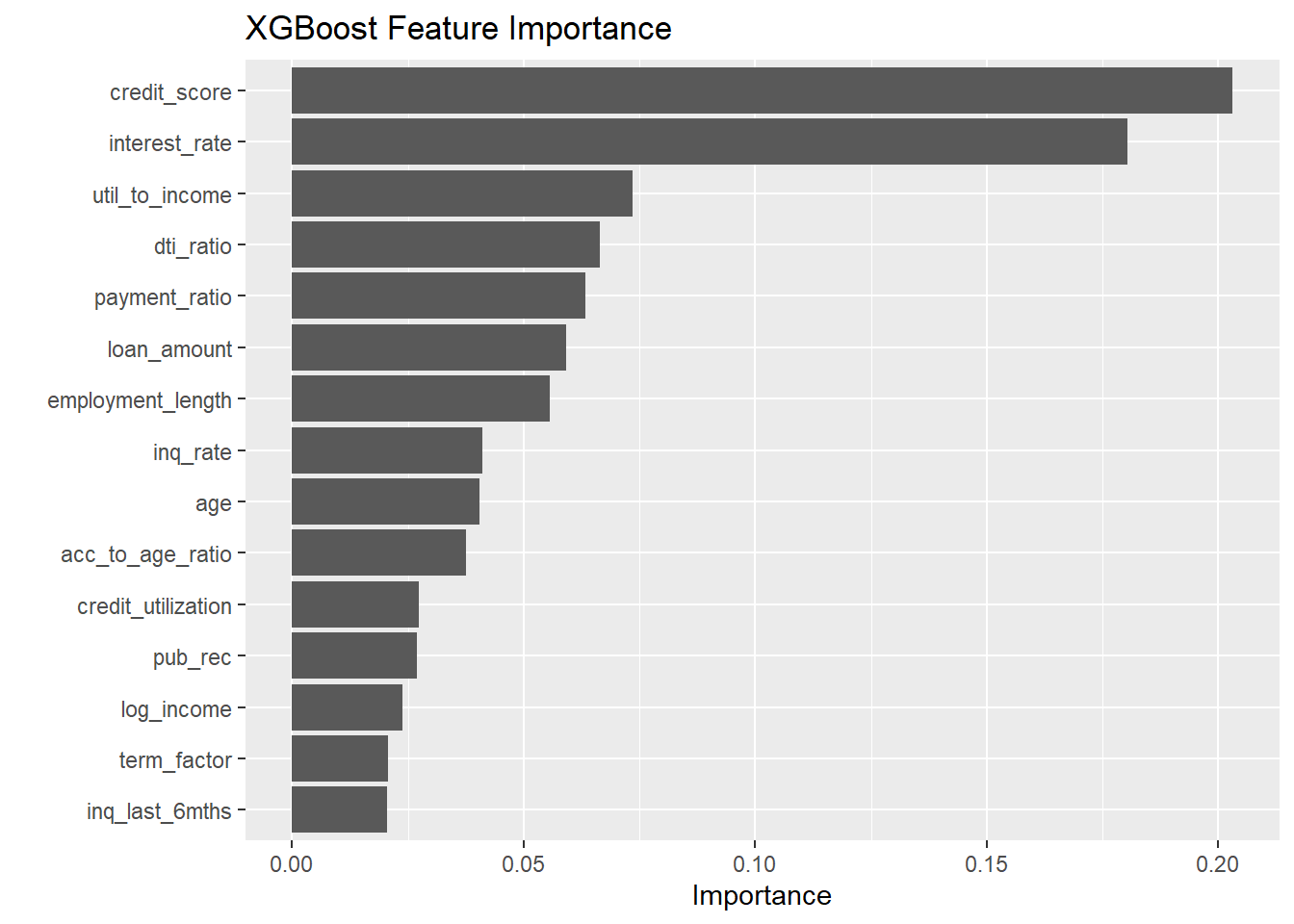

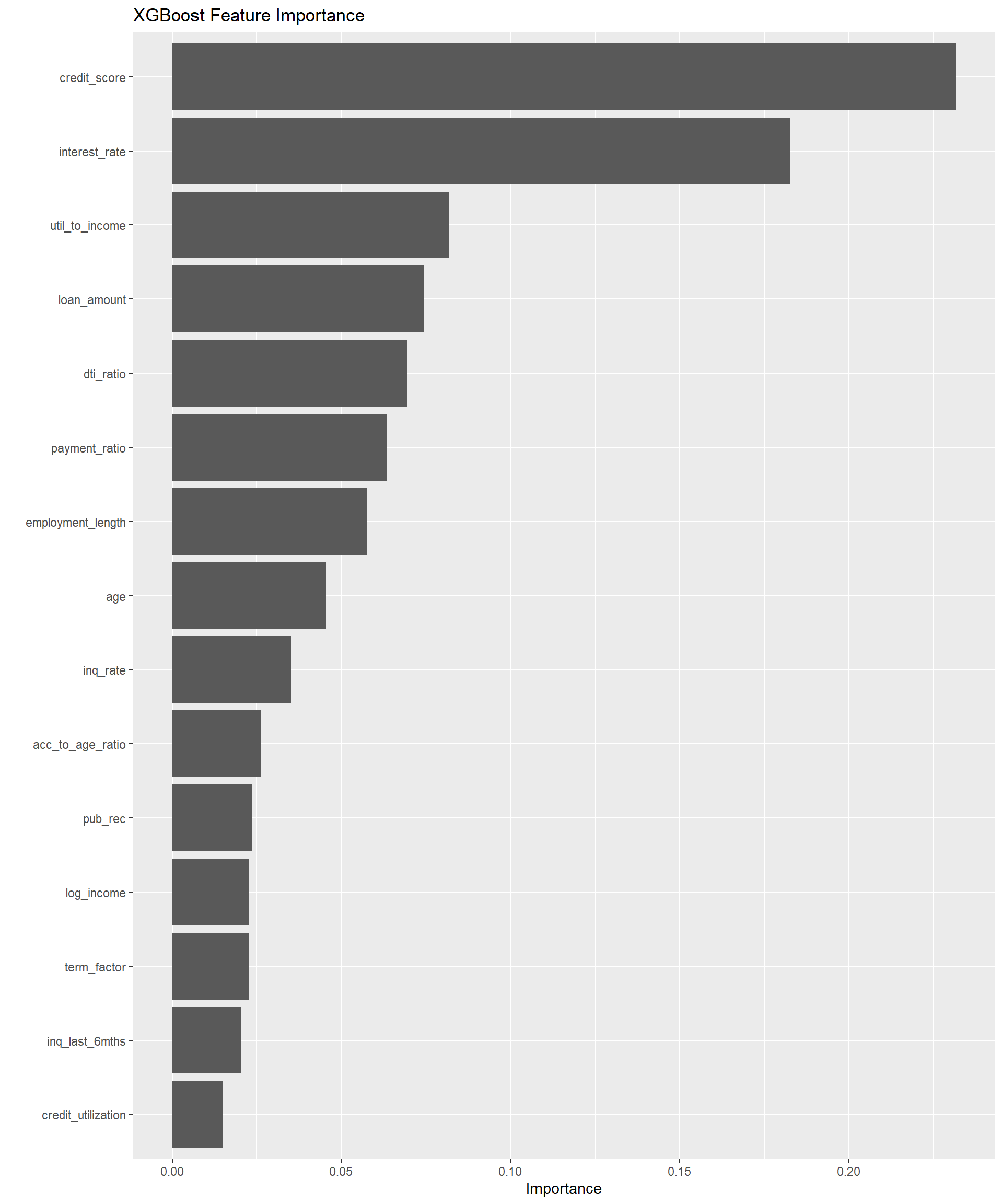

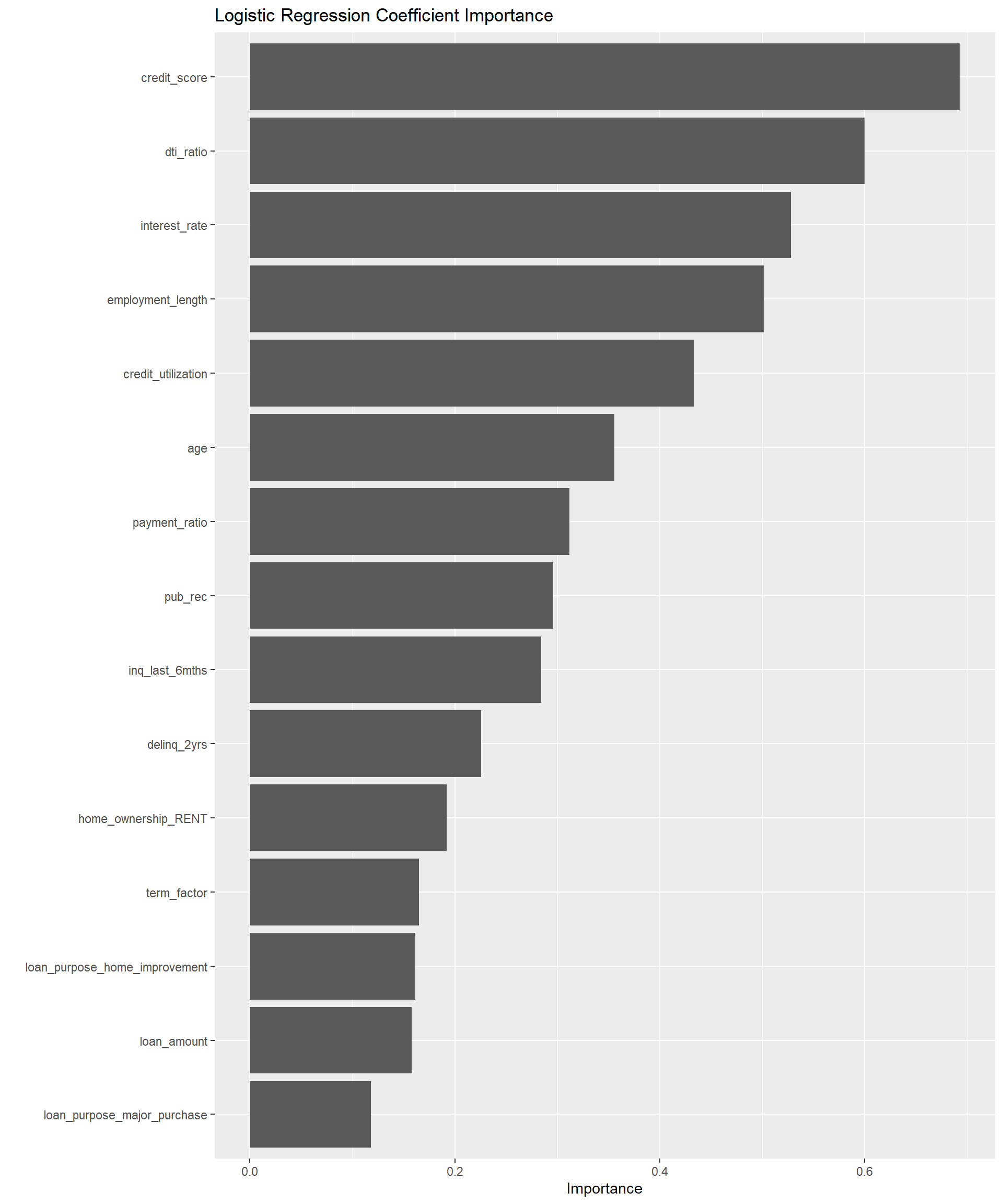

4 roc_auc binary 0.174Interpretability and Feature Importance

Understanding feature contributions to prediction outcomes represents a critical requirement for credit scoring models, particularly for regulatory compliance and business decision-making.

# Extract feature importance from XGBoost model

xgb_importance <- final_xgb_model %>%

extract_fit_parsnip() %>%

vip(num_features = 15) +

labs(title = "XGBoost Feature Importance")

xgb_importance

# Extract coefficients from logistic regression model

log_reg_importance <- final_log_reg_model %>%

extract_fit_parsnip() %>%

vip(num_features = 15) +

labs(title = "Logistic Regression Coefficient Importance")

log_reg_importance

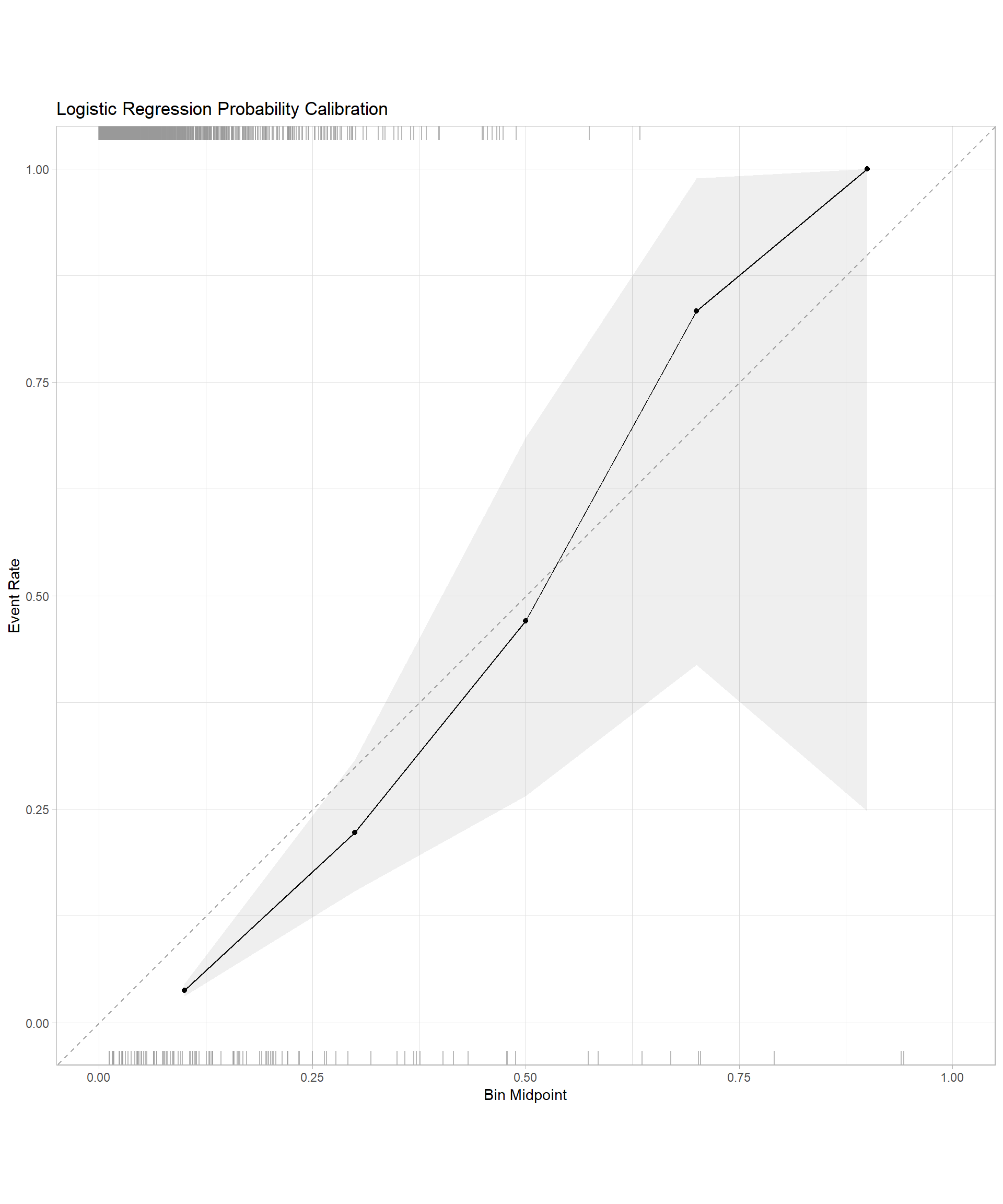

# Create calibration plots for both models

log_reg_cal <- log_reg_val_results %>%

cal_plot_breaks(truth = default, estimate = .pred_yes, event_level = "second", num_breaks = 5) +

labs(title = "Logistic Regression Probability Calibration")

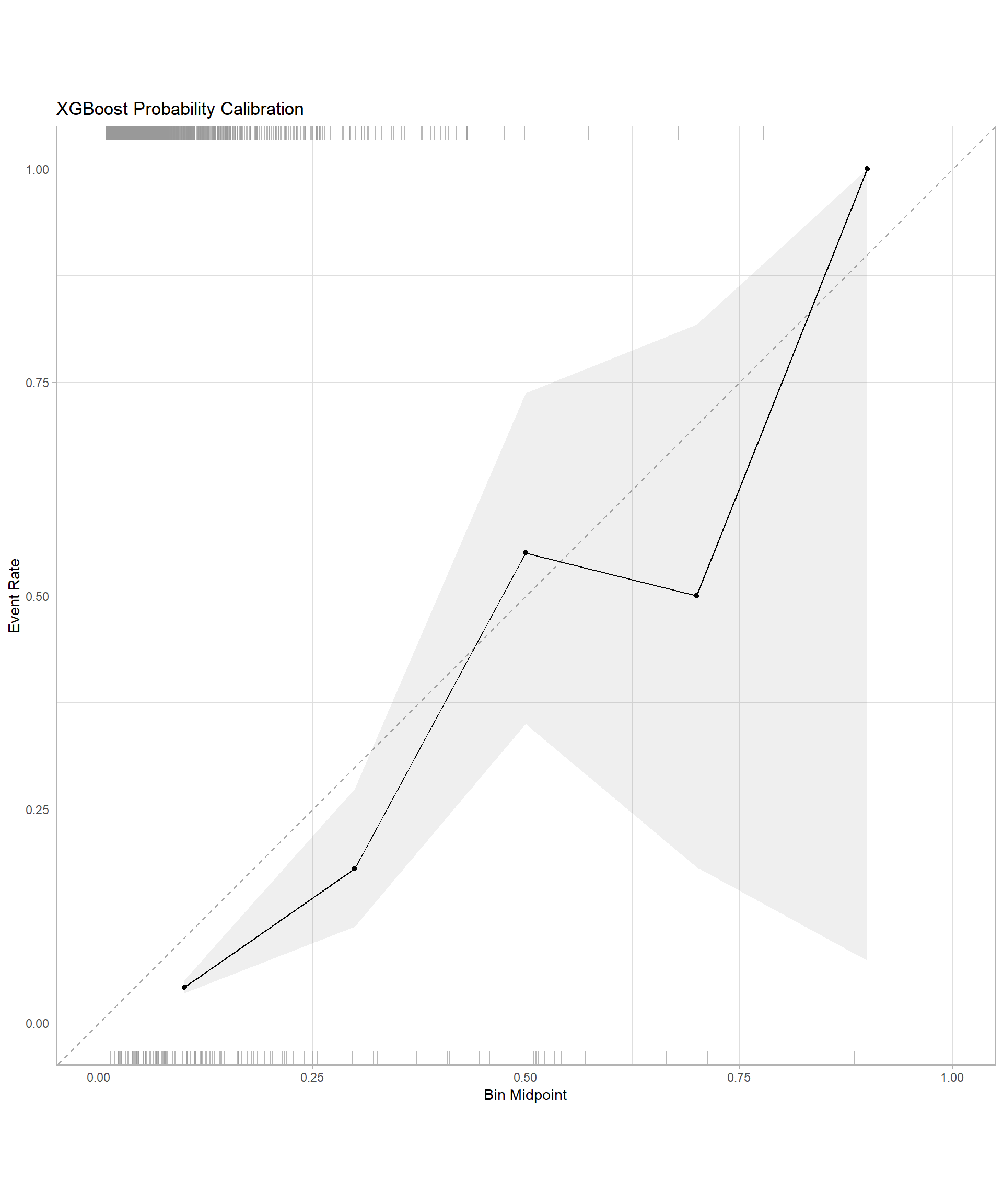

xgb_cal <- xgb_val_results %>%

cal_plot_breaks(truth = default, estimate = .pred_yes, event_level = "second", num_breaks = 5) +

labs(title = "XGBoost Probability Calibration")

log_reg_cal

xgb_cal

Test Set Evaluation

The final evaluation employs the optimal model (XGBoost) on the held-out test dataset to provide an unbiased assessment of generalization performance and operational effectiveness.

# Make predictions on the test set with the XGBoost model

test_results <- final_xgb_model %>%

predict(test_data) %>%

bind_cols(predict(final_xgb_model, test_data, type = "prob")) %>%

bind_cols(test_data %>% select(default, customer_id, credit_score))

# Calculate performance metrics

test_metrics <- test_results %>%

metrics(truth = default, estimate = .pred_class, .pred_yes)

cat("Final Test Set Performance Metrics:\n")Final Test Set Performance Metrics:print(test_metrics)# A tibble: 4 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 accuracy binary 0.932

2 kap binary 0.0184

3 mn_log_loss binary 3.24

4 roc_auc binary 0.169 # Calculate AUC on test set

test_auc <- test_results %>%

roc_auc(truth = default, .pred_yes)

cat("\nTest Set ROC AUC: ", test_auc$.estimate, "\n")

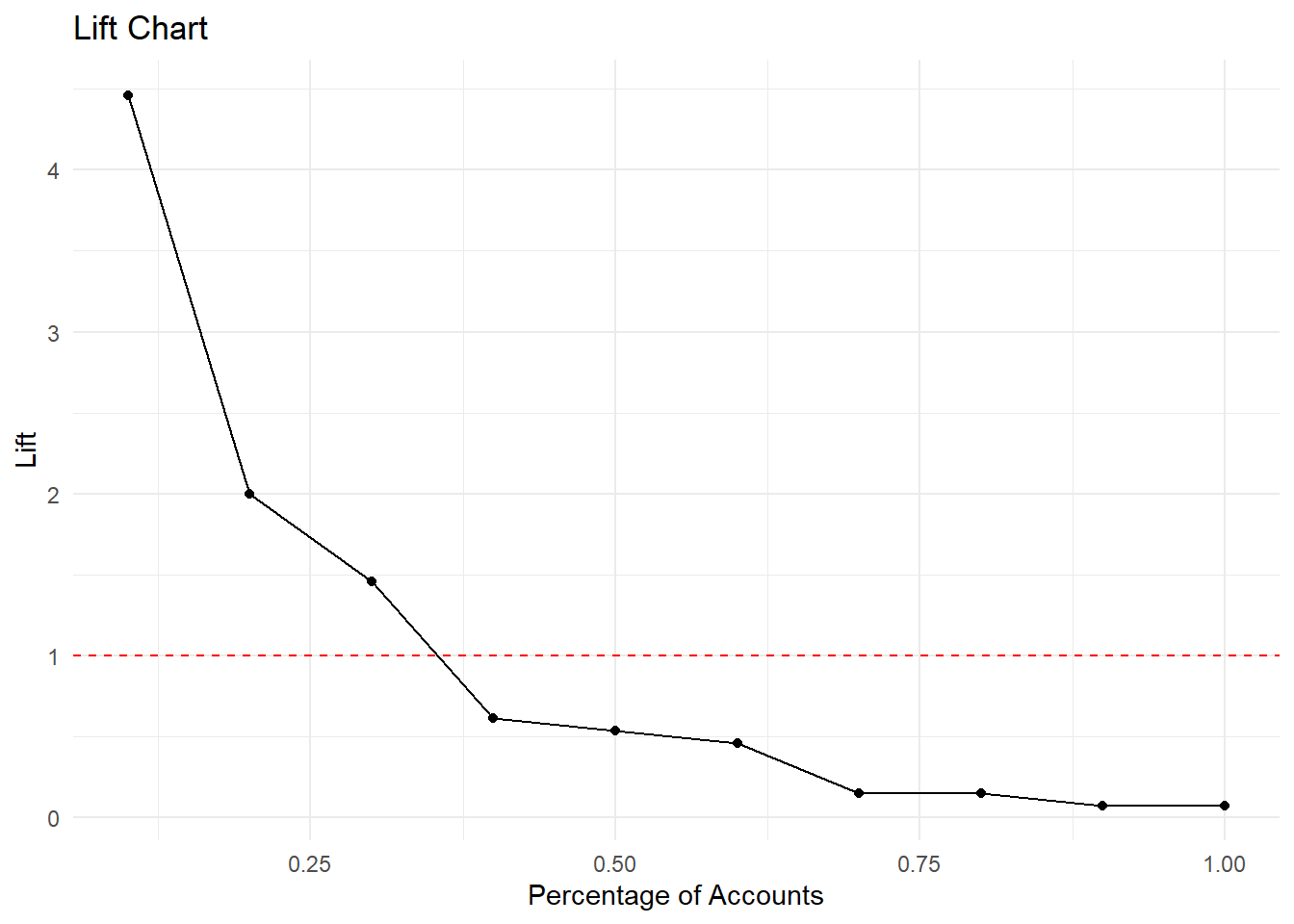

Test Set ROC AUC: 0.1689963 # Create a gains table (commonly used in credit scoring)

gains_table <- test_results %>%

mutate(risk_decile = ntile(.pred_yes, 10)) %>%

group_by(risk_decile) %>%

summarise(

total_accounts = n(),

defaults = sum(default == "yes"),

non_defaults = sum(default == "no"),

default_rate = mean(default == "yes"),

avg_score = mean(credit_score)) %>%

arrange(desc(default_rate)) %>%

mutate(

cumulative_defaults = cumsum(defaults),

pct_defaults_captured = cumulative_defaults / sum(defaults),

cumulative_accounts = cumsum(total_accounts),

pct_accounts = cumulative_accounts / sum(total_accounts),

lift = default_rate / (sum(defaults) / sum(total_accounts))

)

# Display the gains table

gains_table# A tibble: 10 × 11

risk_decile total_accounts defaults non_defaults default_rate avg_score

<int> <int> <int> <int> <dbl> <dbl>

1 10 200 62 138 0.31 578.

2 9 200 24 176 0.12 622.

3 8 200 13 187 0.065 646.

4 7 200 12 188 0.06 662.

5 6 200 7 193 0.035 688.

6 4 200 6 194 0.03 732.

7 5 200 3 197 0.015 714.

8 2 200 2 198 0.01 774.

9 3 200 1 199 0.005 751.

10 1 200 0 200 0 790.

# ℹ 5 more variables: cumulative_defaults <int>, pct_defaults_captured <dbl>,

# cumulative_accounts <int>, pct_accounts <dbl>, lift <dbl># Create a lift chart

ggplot(gains_table, aes(x = pct_accounts, y = lift)) +

geom_line() +

geom_point() +

geom_hline(yintercept = 1, linetype = "dashed", color = "red") +

labs(title = "Lift Chart",

x = "Percentage of Accounts",

y = "Lift") + theme_minimal()

Key Takeaways

- The tidymodels ecosystem provides a unified approach to machine learning workflows, ensuring consistency and reproducibility across model development phases

- Domain knowledge integration is critical for effective feature engineering

- Comparative modeling approaches enhance decision-making by balancing interpretability requirements with predictive performance needs

- Systematic hyperparameter optimization improves model performance while preventing overfitting through cross-validation techniques

- Comprehensive evaluation frameworks ensure robust assessment of model generalization and operational effectiveness

- Model interpretability analysis supports regulatory compliance and business decision-making in financial applications